Bitcoin Price Prediction 2025-2040: Analyzing Technicals and Institutional Adoption Trends

#BTC

- Technical indicators show BTC consolidating near key moving averages with bullish MACD divergence

- Institutional adoption accelerates (MicroStrategy now holds 628,791 BTC) despite some market turbulence

- Long-term price predictions must account for extended cycle timelines per Pi Cycle Top Indicator

BTC Price Prediction

BTC Technical Analysis: Short-Term Consolidation Likely Before Next Move

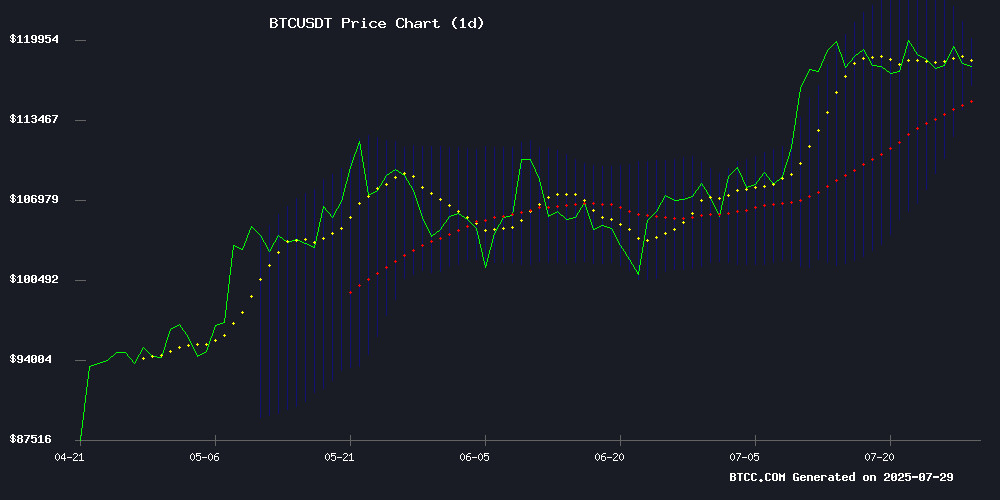

According to BTCC financial analyst Mia, Bitcoin is currently trading slightly below its 20-day moving average (118,181 USDT) at 117,701 USDT, indicating near-term consolidation. The MACD histogram shows bullish momentum building (-1295 vs signal line -3336), while Bollinger Bands suggest support at 116,283 and resistance at 120,078. 'The technical setup shows BTC is digesting recent gains,' Mia notes. 'A sustained break above the 20MA could signal renewed upward momentum.'

Institutional Bitcoin Adoption Accelerates Amid Mixed Market Signals

BTCC's Mia highlights conflicting market narratives: 'MicroStrategy's massive $2.5B BTC purchase (now holding 628,791 BTC) and Ray Dalio's endorsement contrast with Bakkt's 40% stock plunge.' The Pi Cycle Top Indicator's 2027 peak prediction suggests extended bull market potential. 'Institutional adoption is accelerating through treasury strategies and legislative recognition,' Mia observes, 'though short-term volatility may persist with cooling market activity.'

Factors Influencing BTC's Price

MicroStrategy's Bitcoin Strategy Intensifies with $2.5B IPO and 21,021 BTC Purchase

Michael Saylor's Strategy (formerly MicroStrategy) has cemented its position as a Bitcoin powerhouse by closing the largest U.S. IPO of 2025, raising $2.521 billion through its Stretch Preferred Stock (STRC). The proceeds were used to acquire 21,021 Bitcoin at an average price of $117,256 per coin, bringing its total holdings to 628,791 BTC valued at approximately $46.08 billion.

The offering, initially pitched at $500 million, ballooned due to overwhelming institutional demand. STRC shares, carrying a 9% dividend, represent the first perpetual preferred security listed by a bitcoin treasury company. Trading on the Nasdaq under the ticker STRC is set to begin on July 30, 2025.

Strategy's relentless accumulation of Bitcoin underscores its conviction in the digital asset's long-term value. The company's year-to-date BTC yield stands at 25.0%, reflecting both price appreciation and strategic positioning.

Strategy Raises $2.52 Billion in IPO to Acquire 21,021 BTC, Expanding Holdings to 628,791 BTC

Strategy has secured $2.52 billion through its 2025 IPO, marking the largest U.S. offering of the year. The firm sold 28,011,111 shares of its Variable Rate Series A Perpetual Stretch Preferred Stock at $90 per share, with trading set to begin on the Nasdaq Global Select Market under the ticker "STRC" on July 30, 2025.

Net proceeds of approximately $2.474 billion were allocated to purchase 21,021 bitcoins at an average price of $117,256 per BTC. This acquisition boosts Strategy's total Bitcoin holdings to 628,791 BTC, with an average cost basis of $73,227 per coin, including fees. The transaction represents one of the most significant crypto-related deals in recent history.

STRC will become the first exchange-listed perpetual preferred security from a Bitcoin Treasury Company to distribute monthly dividends, setting a new benchmark in the institutional adoption of digital assets.

Pi Cycle Top Indicator Predicts Bitcoin Peak in 2027, Contradicting 2024 Expectations

Market analyst Mark Moss has highlighted the Pi Cycle Top indicator as a historically accurate predictor of Bitcoin's market cycles, with perfect calls on 2013, 2017, and 2021 peaks. Contrary to widespread expectations of a late-2024 top, the tool now forecasts a Q1 2027 cycle peak with a potential $395,000 BTC price target.

The indicator's extended timeline aligns with observations by Rekt Capital, who noted recent Bitcoin rallies may signal cycle elongation. While conventional wisdom suggests a Q4 2024 top based on historical intervals, the Pi Cycle model implies this bull run could extend nearly three years beyond typical expectations.

Michael Saylor Calls Bitcoin a 'Digital Divine Bank' in Bold Endorsement

MicroStrategy CEO Michael Saylor has doubled down on his bullish stance toward Bitcoin, describing it as humanity's closest approximation to a "Digital Divine Bank." The remarks came during a recent podcast interview and were later amplified by Wu Blockchain on social media.

Saylor's theological framing underscores Bitcoin's growing role as a store of value and hedge against monetary debasement. The proclamation arrives amid institutional adoption milestones, including spot ETF approvals and corporate treasury allocations.

Billionaire Ray Dalio Advocates Bitcoin Allocation Amid U.S. Debt Concerns

Ray Dalio, the billionaire founder of Bridgewater Associates, has reiterated his call for investors to allocate 15% of their portfolios to Bitcoin or Gold as a hedge against escalating U.S. fiscal risks. With national debt surpassing $37 trillion, Dalio warns of currency devaluation and systemic instability—a scenario he has accurately predicted in past crises.

The recommendation coincides with the rise of Best Wallet (BEST), a Web3 wallet that has raised $14.3 million in its ICO. The platform offers automated tools for maintaining disciplined Bitcoin exposure, aligning with Dalio’s strategy. BEST tokens remain available at $0.025365 for 34 more hours before the next pricing tier takes effect.

Senator Lummis Proposes Bill to Recognize Bitcoin in Mortgages

U.S. Senator Cynthia Lummis (R-WY) has introduced the 21st Century Mortgage Act, a legislative push that could redefine how digital assets are treated in traditional finance. The bill mandates Fannie Mae and Freddie Mac to consider bitcoin holdings when evaluating single-family home loan applications—without requiring conversion to fiat currency.

This move signals growing institutional recognition of crypto as legitimate collateral. By preserving borrowers' digital asset positions, the policy acknowledges bitcoin's role in modern wealth-building strategies, particularly among younger Americans. Senator Lummis framed the legislation as necessary evolution: "We're living in a digital age, and government agencies must adapt rather than punish innovation."

The proposal establishes a precedent for federal acceptance of blockchain-recorded assets in mainstream lending. Market observers note this could accelerate crypto adoption by bridging decentralized finance with real estate markets—two traditionally siloed sectors now converging through regulatory action.

Public Companies K33, Bakkt, and Zooz Expand Bitcoin Treasury Strategies

Norwegian digital asset firm K33 AB has acquired an additional 5 BTC, bringing its total holdings to 126 BTC. The company now ranks 75th among public Bitcoin treasuries. CEO Torbjorn Bull Jenssen confirmed rapid progress toward a 1,000 BTC target, citing two successfully closed funding rounds as evidence of strategic readiness. K33's stock fell 4.35% following the announcement, continuing a weak performance trend.

Israeli company Zooz unveiled a $180 million private placement to establish a Bitcoin reserve strategy, while U.S.-based Bakkt priced its $75 million public offering. These moves signal growing institutional confidence in Bitcoin's long-term value proposition.

Bitcoin Faces Potential Sell-Off Amid Cooling Market Activity

Bitcoin's upward momentum shows signs of exhaustion as the Relative Strength Index (RSI) retreats from overbought territory to 56. Daily Active Addresses have dipped moderately from 725,000 to 708,000, signaling waning speculative interest. On-chain transfer volume has plummeted 23.1% to $10.8 billion, indicating reduced economic activity on the network.

The cryptocurrency now trades below $118,000, struggling to reclaim the $120,000 level after last week's retreat to $114,728. Market attention shifts to macroeconomic events, with the Federal Reserve's rate decision and Chair Jerome Powell's commentary taking center stage. The implementation of reciprocal tariffs by the US administration adds another layer of market uncertainty.

This cooling period follows Bitcoin's recent all-time highs, which previously catalyzed rallies across altcoin markets. The coming days will prove critical for determining whether Bitcoin can resume its upward trajectory or face further downside pressure.

Bakkt Stock Plummets 40% Following $75M Bitcoin-Focused Offering

Bakkt Holdings Inc. shares cratered more than 40% in premarket trading after pricing a $75 million public offering to fund Bitcoin acquisitions. The digital asset platform plans to transform into a pure-play Bitcoin infrastructure company as part of its revised treasury strategy.

The offering comprises 6.75 million Class A shares at $10 each, plus warrants for 746,373 additional shares. Clear Street and Cohen & Company Capital Markets are managing the sale, which could expand by 1.13 million shares if underwriters exercise their full greenshoe option.

Proceeds will primarily fund Bitcoin and digital asset purchases, with remaining capital allocated to working capital needs. The dramatic market reaction reflects investor concerns about dilution amid Bakkt's aggressive pivot to cryptocurrency infrastructure.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and institutional adoption trends, BTCC's Mia provides these long-term projections:

| Year | Price Range (USDT) | Key Drivers |

|---|---|---|

| 2025 | 85,000-150,000 | ETF flows, halving aftermath |

| 2030 | 300,000-500,000 | Institutional adoption, scarcity premium |

| 2035 | 750,000-1.2M | Global reserve asset status |

| 2040 | 1.5M-3M+ | Network effect maturity |

Note: Predictions assume continued adoption without black swan events. The Pi Cycle Top Indicator suggests cycle peaks may extend beyond 2024 expectations.